52+ can you deduct mortgage interest on rental property

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence.

Walzel Properties Katy Har Com

Only the mortgage interest can be entered as an expenses for the rental property not the principal.

. Web Up to 25 cash back You cant deduct as interest any expenses you pay to obtain a mortgage on your rental property. Web June 4 2019 1135 PM. Ad Browse Discover Thousands of Business Investing Book Titles for Less.

Web If you itemize your deductions on Schedule A of your 1040 you can deduct the mortgage interest and property taxes youve paid. For many people the extra income earned from renting out. Get Help with Taxes Online and Save Time.

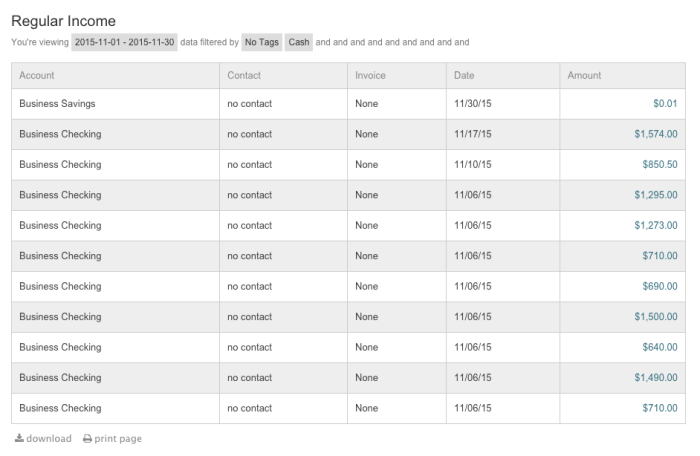

Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage. For tax years before 2018 the. Web According to one report the average Airbnb host earned more than 13800 1150 a month in 2021.

Web If your rental property produces 50000 in rental income for the year you can take a 15000 deduction for the mortgage interest which reduces your taxable rental. Web Web The rental property mortgage interest deduction offers significant tax benefits. Instead these expenses are added to your basis in the.

Web How to deduct mortgage interest on federal tax returns When you file taxes you can take the standard deduction or the itemized deduction. Ad Questions Answered Every 9 Seconds. When you include the fair market value of the property or services in.

Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional. Get Personalized Answers to Tax Questions From Certified Tax Pros 247. You should have entered the.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Many other settlement fees and closing costs for. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Heres how it works using an example property purchased for 325000 with a. Web The rental property mortgage interest deduction offers significant tax benefits. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Rocky Point Times March 2022 By Rocky Point Services Issuu

Vacation Home Rentals And The Tcja Journal Of Accountancy

G136892ko23i008 Gif

Is Your Mortgage Considered An Expense For Rental Property

Gak Group Hyderabad

Can You Claim Rental Mortgage Interest As An Itemized Deduction

:max_bytes(150000):strip_icc()/house-keys-and-contract-on-table-in-house-rental-1082558850-f4ceefa00b2f4b08b84c4ae77d17dd65.jpg)

The Tax Benefits Of Owning A Rental Property

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

How A Healthy Buy To Let Profit Could Soon Become A Painful Loss Buying To Let The Guardian

Rvnpb1wl9kytm

Dutch 30 Percent Ruling Americans Overseas

How Income Tax Planning Software Can Help You Support Businesses Corvee

52 Residential Property In Rajkot Residential Apartments Flats Houses For Sale In Rajkot Justdial Real Estate

Can You Claim Rental Mortgage Interest As An Itemized Deduction Budgeting Money The Nest

Deduction Of Mortgage Interest On Rental Property

52 Residential Property In Guwahati Residential Apartments Flats Houses For Sale In Guwahati Justdial Real Estate

The Complete Idiots Guide To Buying A Piano Pdf Piano Box Zithers